Empowering the Banking Sector

ByteVolt takes pride in empowering the banking sector with a comprehensive suite of IT services designed to enhance security, customer experience, and operational efficiency. Through our innovative solutions, we have transformed the industry landscape, delivering measurable improvements in processes and outcomes.

Our tailored IT services are strategically crafted to address the specific needs of banks and financial institutions. We prioritise security, implementing robust measures to safeguard sensitive data and mitigate cyber threats. Our expertise in cybersecurity ensures that your digital assets remain protected, earning the trust of customers and regulatory bodies alike.

ByteVolt: Reimagine Banking

with AI-Powered Solutions

with AI-Powered Solutions

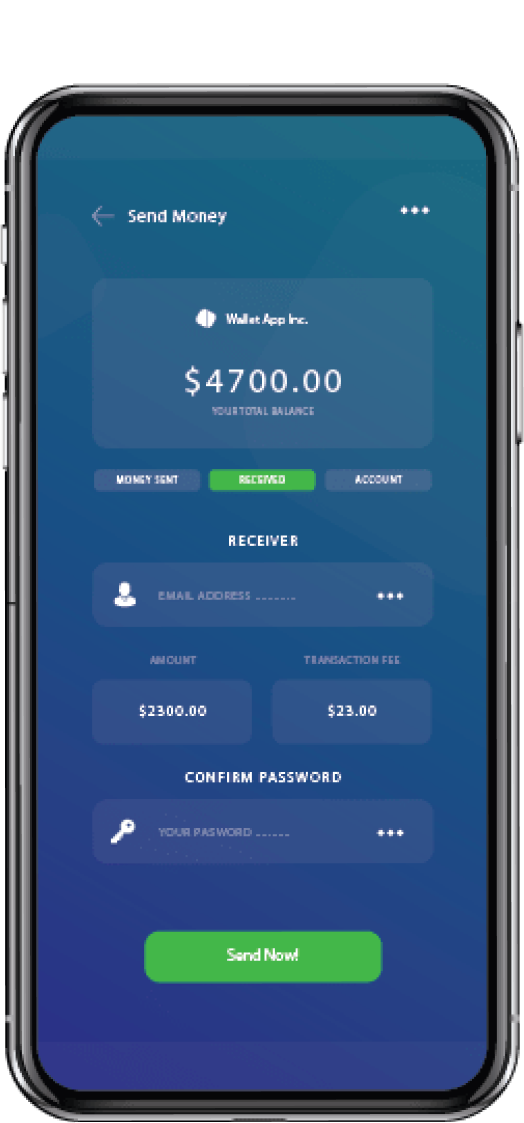

Mobile Banking Software Solutions

ByteVolt's financial software development services produce robust, simple online banking system solutions for brick-and-mortar and FinTech organisations of any size, with branding for consistency and exposure.

Custom Online Banking

Software

Software

ByteVolt's financial software development services produce robust, simple online banking system solutions for brick-and-mortar and FinTech organisations of any size, with branding for consistency and exposure.

Personalized Online

Banking Platforms

Banking Platforms

Our safe platforms enable encrypted bi-lateral transactions, crowdfunding, multi-currency e-wallets, cryptocurrency trading, and social media money transfers.

Personalized Online

Banking Apps

Banking Apps

Our bespoke mobile app development services make hybrid mobile banking apps that employ Apache Cordova (previously PhoneGap) to deliver unified user experiences across web, iOS, and Android channels easy for your consumers to bank on the move.

Custom Online Banking Security

ByteVolt's banking solutions professionals deploy risk management tools and network security features as TCI/IP, SSL/TLS, MFA, OTP, SSO, and SFTP.

MENU

CONTACT

-

+1 213-254-5269

+1 213-254-5269 -

sales@bytevolt.io

sales@bytevolt.io